Singapore pays the price for picking favorites

(Next Magazine, 2016/9/1, A002, Second Opinion, Bill Stacey)

Singapore pays the price for picking favorites

The front page of England’s venerable weekly The Spectator headlined an essay titled “The Doom Delusion”. The author Johan Norberg points out that objective evidence shows that “there’s never been a better time to be alive”, but “we’re hardwired not to believe this. We’ve evolved to be suspicious and fretful: fear and worry are tools for survival”.

This delusion is ever present in Hong Kong. While we are beset with many real problems, there is no cause to fear darker prospects than are likely. As the Legislative Council and Chief Executive elections draw near, it is vital that we understand not just the problems that we have, but also our strengths. If we do not recognize what is right in Hong Kong and exaggerate our ailments, our elected and unelected officials are likely to prescribe the wrong medicines.

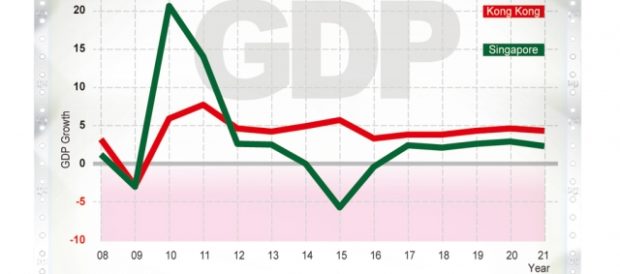

Economically, we are not doing so badly compared with many other economies. Since the global financial crisis, our nominal GDP growth per capita has averaged 4.26%, which is higher and more stable than the growth rates registered in Singapore and Korea, two of the countries that our political masters often look to for examples. The IMF projects that, in the next five years, we will continue to command an almost 1% per capita growth advantage over Singapore.

There are several reasons for this edge. In many ways we have a more flexible economy. We do not have activist industry policies and planning that risk misallocation of capital. Singapore’s planning regime long ago decided that the city-state should become a hub for IT. In the fading PC era, Singapore was home to manufacturing for many of the more advanced parts in our computers. However, as the PC has become commoditized, this part of Singapore’s economy has weakened. It also decided to boost its IT industry by requiring local storage of almost all data for financial firms. In the era of the global “cloud”, this has become a real problem for Singapore.

Singapore has always been a vital shipping hub; and its government has done everything it can, policy wise, to keep this industry alive. However, the recent slump in freight rates has not been kind to Singapore-headquartered shipping companies.

Singapore has put many eggs in the basket of becoming a financial center, offering a raft of subsidies and incentives to companies that choose the city as a base or regional headquarters, and particularly favoring large financial firms that can become big employers. Given its low tax regime, location, and rule of law, Singapore will always have a key role to play in the global financial services industry. However, with the spread of the financial crisis, Singapore has found that the financial sector is scaling back while the fintech revolution is threatening the behemoths that it encourages.

It is true that our officials have also chosen target industries and sought to boost their development – many being the same industries selected by Singapore and many other regional centers. Frankly, these measures have been ineffectual, and this is a good thing. Restrained by prudent budgeting, legislative gridlock, rule-bound officials, and residual respect for the market, Hong Kong has been less effective at creating market-distorting privileged industries.

Moreover, China has provided a competitive check on our government. It makes no sense to subsidize our ports and shipping, while on our doorstep lies Yantian with real competitive advantages. Why create an industry policy for financial services, when some of the most interesting innovations in the world are happening in Shenzhen, China’s second financial center. Our companies have been able to nimbly integrate with these developments in China. As a result, we have avoided gross misallocations of capital. Integration has been largely driven by private enterprise and our very real comparative advantages.

In this election season, we must avoid the siren song of promises to close borders and redesign our industries, our culture, and relatively free markets. That hubris, often founded on unjustified fear, will simply stunt our growth.

Bill Stacey